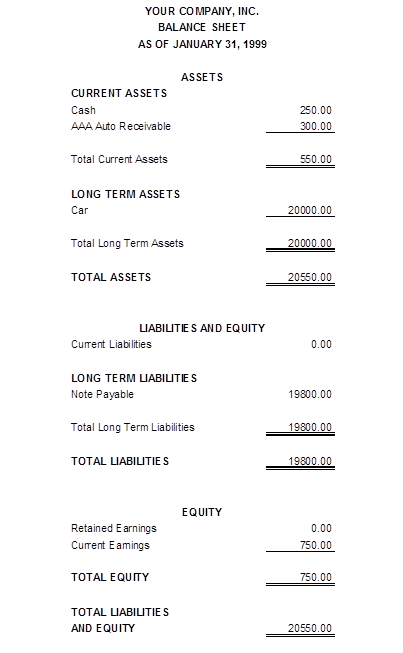

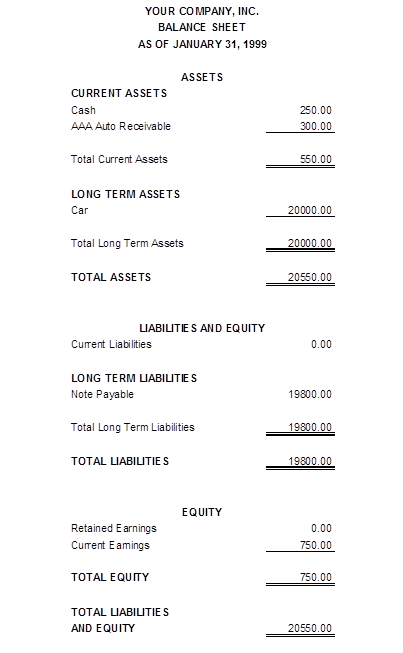

The balance sheet is a summary of the assets and the liabilities of a company. Assets always equal liabilities plus equity. The equity account can be thought of as the account that balances a company's worth (assets), to its debts (liabilities). If a company owns more assets than they owe for liabilities, the equity account will have a credit balance, meaning the owners or stockholders would have money left over if the company liquidated. If more is owed to liabilities than is available in the asset accounts, the company’s equity account will have a debit balance, meaning the owners or stockholders would have to come up with additional funds to pay off their liabilities if the company was to liquidate. The balance sheet is normally broken down into two major sections, assets and liabilities. Within the liabilities section is the equity accounts and the current earnings account. The equity accounts are normally not adjusted but once a year at the year end, it is the current earnings account that reflects the current year income or loss. The equity accounts reflect the net of all previous years’ income or loss. Only asset, liabilities and equity accounts show on the balance sheet. All asset accounts are totaled giving the total assets. All liabilities and equity accounts are totaled giving the total liabilities and equity. The following is a balance sheet for the sample transactions and income statement we have been using.

Note that the current earnings from the income statement is shown on the balance sheet. This amount, plus the retained earnings, is the companies net worth. If this company was to liquidate, they would sell the car for $20,000.00 (depreciation was not used in this simple example), payoff the bank note with the proceeds and have $200 left to add to the $250 already in the bank. Finally, they would collect the $300 from AAA Auto and end up with a total of $750, their net worth.