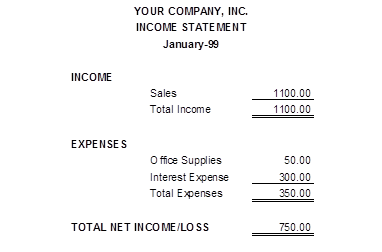

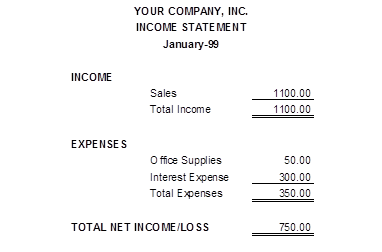

In double-sided accounting the means of determining whether the company is operating at a profit or a loss is provided through the use of the income statement. An income statement is generally broken down into two categories, income and expenses. Only income and expense accounts are shown on the income statement, all other account types are shown on the balance sheet. All income accounts are added giving the gross income and then all expenses are added giving the total expenses. The net of gross income minus total expenses is the company’s net income before taxes. The following is an income statement for the above sample transactions.

The company has produced a profit of $750.00 for the month of January. This amount is usually referred to as the current earnings for the company. The sum of each month’s current earnings is shown as the current earnings balance for the year on the balance sheet. It can be thought of as the amount of money the company has made (or lost) so far in the current year.