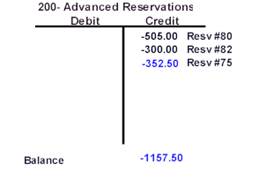

The T-account below shows the company’s liability to the guest for the money received.

The following tutorial will show how reservation money

flows through RMS. We will use seven reservations. The table below

shows the taxes, fees and charges for each reservation. Keep in mind that

it is possible for RMS to charge the same taxes and fees for each unit or to

calculate the amounts uniquely.

|

Reservation |

# 75 |

# 76 |

# 77 |

# 78 |

# 79 |

# 80 |

# 82 |

|

Unit # |

435 |

120 |

435 |

6 |

1100 |

100 |

10 |

|

Rent |

705.00 |

610.00 |

810.00 |

2010.00 |

1510.00 |

1010.00 |

600.00 |

|

Tax 1 |

35.25 |

30.50 |

40.50 |

100.50 |

75.50 |

50.50 |

30.00 |

|

Tax 2 |

14.17 |

12.27 |

16.27 |

40.27 |

30.27 |

20.27 |

12.00 |

|

Charges |

3.50 |

3.50 |

3.50 |

3.50 |

3.50 |

3.50 |

0.00 |

|

Total due |

757.92 |

656.27 |

870.27 |

2154.27 |

1619.27 |

1084.27 |

642.00 |

|

| |||||||

|

Deposit |

352.50 |

350.00 |

405.00 |

502.50 |

0.00 |

505.00 |

300.00 |

|

Total Includes: | |||||||

|

Embedded Fee |

5.00 |

10.00 |

10.00 |

10.00 |

10.00 |

10.00 |

0.00 |

|

Cleaning |

40.00 |

35.00 |

40.00 |

75.00 |

75.00 |

50.00 |

35.00 |

|

Commission |

175.00 |

120.00 |

200.00 |

700.00 |

292.50 |

250.00 |

120.00 |

RMS offers seven different types of deposits to choose

from when booking a reservation. Each of our guests will use a different

deposit method when they call to book the reservation. You will be

able to track how the reservation money flows through RMS by following each of

their reservation payments.

1. No deposit required (resv#79)

2. Deposit by credit card (resv#75)

3. Deposit by check guaranteed with a credit card (#76)

4. Deposit by check no credit card. (#78)

5. Deposit "received". (#80)

6. Deposit by check but also gave cc info. (#77)

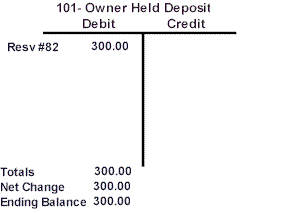

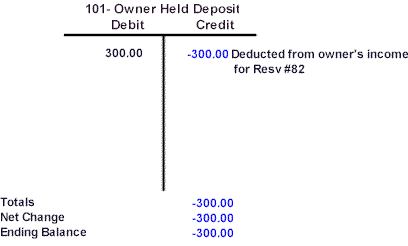

7. Deposit paid to owner. (#82)

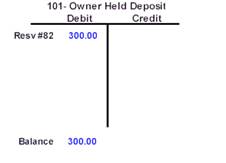

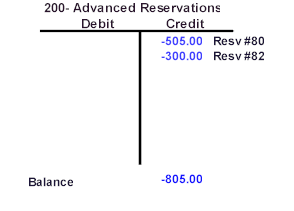

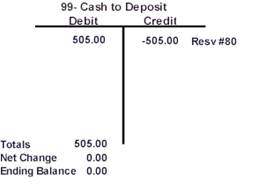

Everybody booked their reservations the same day, but

since they all chose different deposit methods RMS has to track the money

accordingly. The deposits for reservations #80 and #82 were considered

paid when booked. Since they were considered paid at the time they were

booked, transactions were created in the general ledger to the specific accounts

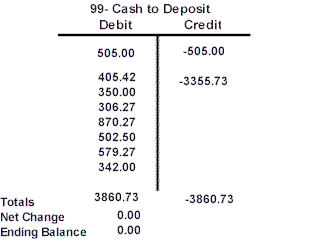

involved. A Debit was made to these accounts: Cash to Deposit account (99)

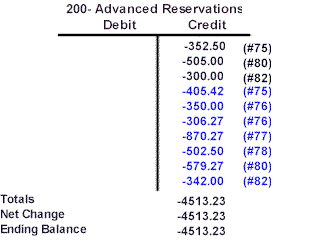

and Owner Held Deposit account (101). Credits were posted to Advanced

Reservations account (200). Here is what the accounts look like using a T

account diagram:

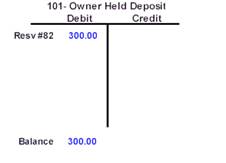

The T-account below shows

the company’s liability to the guest for the money received.

Credits are created in the Advanced Reservations Account.

The ending balance for the Advanced Reservations Account = -805.00

Credits are always shown as negative numbers.

Credit Card Report

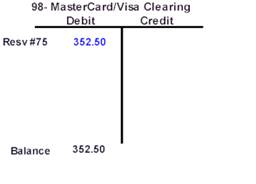

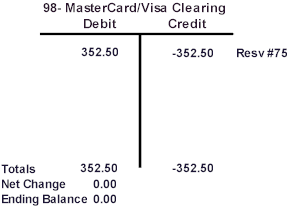

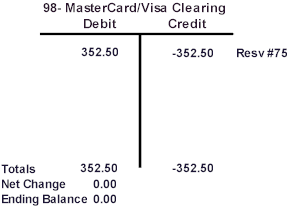

Reservation #75 paid his deposit by credit card. When RMS books a reservation by credit card, the payment does not show when you view the reservation, and the payment does not become a GL transaction until the credit card report is processed. Once the credit card report is processed, a Debit is made to the Credit Card clearing account (98) and a credit is made to Advanced Reservations (200). So after the credit card report is processed the accounts look like this:

The ending balance for the M/V Credit Card Clearing Account = 352.50 showing Reservation #75’s payment.

The ending balance after the credit card is processed in RMS for the Advanced Reservation Account = -1157.52. Showing the total amount being held for reservation payments.

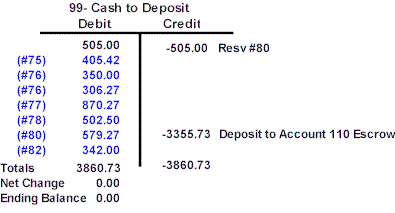

Deposit Report

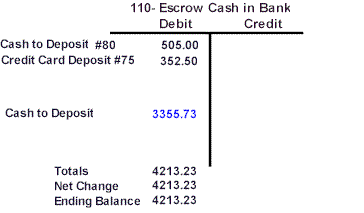

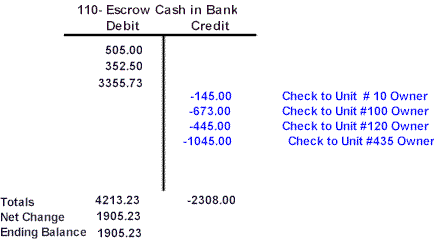

Rhonda, in the ABC Rentals, Inc. Accounting department faithfully and meticulously runs her deposit report in RMS until she is satisfied with it. No GL transactions occur when she runs the deposit report. She can run it as many times as she needs in order to balance the report to the cash and check deposit that she has prepared to take to the bank. She also reconciles the credit card section of the Deposit report to her credit card machine batch totals. When she processes the deposit report, which today will include reservations #75, #80 and #82’s deposits, credits are created in the credit card clearing account and the cash to deposit account. This processing of the Deposit report "moves" the total of the transactions for the day to the escrow cash in bank account. Processing the deposit entries "deposits" the collected funds into the bank. Two deposits are made for the cash to deposit and one for the cc to deposit. Deposit register entries are also created. The Owner Held Deposit account remains the same.

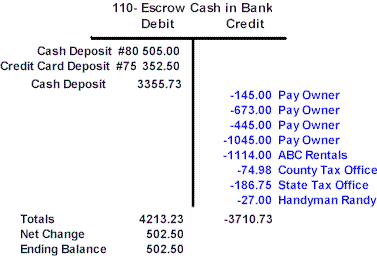

Two debit transactions are created for Escrow Cash in Bank (110). The Escrow Cash in Bank account has an ending balance of 857.50. The Owner Held Deposit account remains the same. It will not change until the Owner statement is finalized. The Deposit Summary Report prints after the deposit is processed. The Total Deposit = 857.50. The deposit is made up of 505.00 from checks and cash and the 352.50 from credit card.

In summary, seven reservations were booked. Three of the reservations booked created transactions when the reservations were booked because of the type of deposit that was used. The two reservation deposit types that created GL transactions were Deposit Received and Owner Held. The Credit Card type deposit did not create a GL transaction or a reservation payment until the credit card report was processed. If you were to print or view a Trial Balance report prior to processing the credit card report the credit card GL entry would not be on it. After the credit card report is processed the GL transaction is listed in the trial balance. RMS requires that the credit card report is run or processed. The credit card report should be printed before the Deposit report.

After the credit card report was processed, the Deposit report was printed. This report should reflect the money you have ready to deposit into the bank. After the Deposit report was printed, the Deposit was processed. The total Deposit processed should reflect the amount of money you actually deposit in the bank.

Accounts 98,99 &101 will contain GL’s due to the type of deposit chosen. These accounts act as a "Holding" or "Clearing" account for money to deposit.

Account 110 (Escrow) is a current asset account and usually will contain an ending debit balance.

Account 200 (Advanced Reservations) is a current liability account. It will usually contain an ending credit balance.

Additional Payments

Timely payments by check are mailed by six of the guests who booked reservations at ABC Rentals, Inc. Reservation #79 doesn’t send any money. Reservation #76 sends two checks totaling the amount due. This list is similar to what a Reservation Payments Report would look like after Rhonda, the bookkeeper, entered the payments via the Payments Received option on the Reservation Menu. Ann enters the check numbers into the description field when she posts check payments in RMS.

Transaction# |

Date |

Resv # |

Description |

Amount |

|

56 |

02/02/02 |

75 |

Ck#1293 |

405.42 |

|

350 |

02/02/02 |

76 |

Ck#1234 |

350.00 |

|

362 |

02/02/02 |

76 |

Ck#4949 |

306.27 |

|

352 |

02/02/02 |

77 |

Ck#4984 |

870.27 |

|

354 |

02/02/02 |

78 |

Ck#494 |

502.50 |

|

358 |

02/02/02 |

80 |

Ck#4958 |

579.27 |

|

360 |

02/02/02 |

82 |

Ck#9674 |

342.00 |

Total |

3355.46 | |||

A trial balance would show seven debits created in account # 99 the Cash to Deposit Account.

The Ending Balance for these transactions = 3355.73

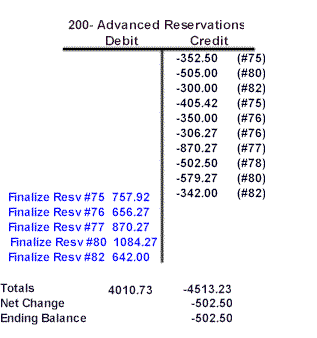

The trial balance detail would also show seven credits in account #200, Advanced Reservation Deposits. This reflects the liability we now have for the money paid for the reservations booked.

The Ending Balance for today’s transactions = -3355.73

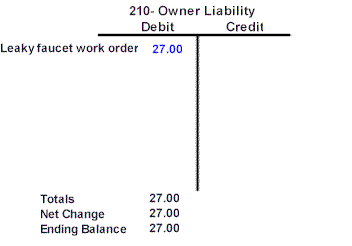

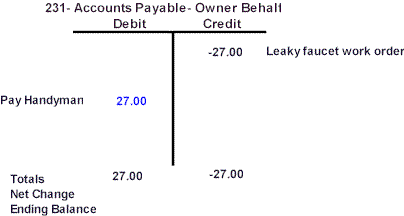

Work Order Entry

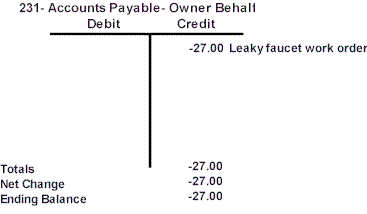

Meanwhile, behind the scenes at ABC Rentals, Inc. it is not an entirely perfect world for everyone. Handyman Randy gets a call from the property manager to repair a leaky sink for one of the properties. Handyman Randy charges 27 dollars for the repair. The property manager enters a work order for 27.00 using the work order entry option in Accounting. A GL transaction is created when a work order is entered this way.

The work order created a debit of 27.00 to account #210, Owner Liability and a credit for 27.00 to the Accounts Payable-Owner Behalf, account #231. In addition to the general ledger entries that are created, this work order entered via the accounting menu also creates a work order charge to the owner statement and sets up a payable for the vendor, Handyman Randy.

Deposit Process

Rhonda, the bookkeeper, runs the credit card report then runs the Deposit Report to include all cash check and credit card transactions. The seven checks are listed with a Total Cash Amount = 3355.73. She processes her deposit report and her Deposit summary reports a Total Cash Deposit of 3355.73. When she processes the Deposit, a debit is then posted to the Escrow Cash in Bank account, #110 for 3355.73. Processing the Deposit also posts a credit to her Cash to Deposit account of –3355.73. These transactions show the deposit of the payments posted. The Cash to Deposit account might be thought of as the cash drawer. All payments are put there until they are taken to the bank. Processing the deposit report reflects the act of "taking the money to the bank". Her Owner Liability Account and her Accounts Payable-owner Behalf remain the same. They will not change until the vendor gets paid.

To look at the totals to date, Rhonda, the bookkeeper, runs a detail trial balance. She views each transaction within each account and notes the debits and credits are correct. She looks over other details on the trial balance. Each transaction has a number, a date, a description, a type code (where it was generated or the source of the transaction), a set number, a reservation number, a unit number and the transaction value of debit or credit. This information is all very helpful and Rhonda finds everything is just perfect. The T accounts show what she sees.

There is no new activity in this account.

There is no new activity in this account.

Owner Statements

The guests arrive at ABC Rentals, Inc. The accommodations are superior, the food is fabulous and the view is spectacular. The time comes when they all must return to their normal daily lives.

All the guests paid for their reservations and departed singing the praises of such a fantastic family vacation spot. It also happens to be time for Rhonda to send out statements to all the owners who had reservations in their units. She will report to the owners via the owner statement she prints out from RMS each month. The owner statement reports the following information: rental income, arrival and departure dates, reservation number, reservation status, gross amount, cleaning charges, credit card discount, referral fee, commission and net income. It also includes any maintenance expenses, such as the leaky faucet work order, and any miscellaneous receipts and disbursements. Rhonda prints these until they are just perfect. Statements may be printed as many times as needed. Rhonda usually prints the statements, reviews them, posts any changes or corrections and prints them again. Finally, all of Rhonda’s statements print out perfectly so she decides to finalize them.

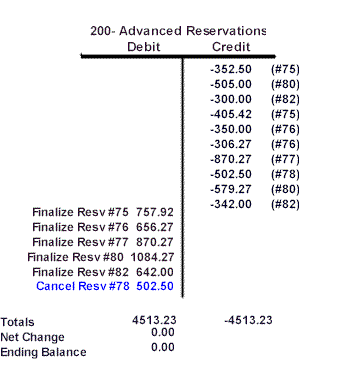

The finalization process for owner statements creates the reservation general ledger transactions, prints the owner checks, updates the units balance forward with the last statement balance, updates the unit to date totals, updates the 1099 totals, prints the monthly reservation summary and archives the reservations and owner transactions that appeared on the statement.

This table displays a summary of the information that appeared on the owner statements in our example.

|

Unit # |

10 |

100 |

120 |

435 | |

|

Resv. Dates |

2/22-2/28 |

2/15-2/22 |

2/15-2/22 |

2/01-2/08 |

2/21-2/28 |

|

Resv # |

82 |

80 |

76 |

75 |

77 |

|

Resv Status |

B |

A |

A |

A |

A |

|

Gross |

600.00 |

1000.00 |

600.00 |

700.00 |

800.00 |

|

Less Cleaning |

35.00 |

50.00 |

35.00 |

40.00 |

40.00 |

|

Less Referral |

300.00 |

0.00 |

0.00 |

0.00 |

0.00 |

|

Less Commission |

120.00 |

250.00 |

120.00 |

175.00 |

200.00 |

|

Net |

145.00 |

700.00 |

445.00 |

484.00 |

560.00 |

|

Less Maintenance |

0.00 |

27.00 |

0.00 |

0.00 | |

|

Due to/from owner |

145.00 |

673.00 |

445.00 |

1045.00 | |

After Rhonda has finalized all the owner statements, which includes paying the owners, her complete trial balance detail report will show the following debits and credits: (new transactions will be in blue type)

There is no new activity in the MasterCard/Visa account.

Owner checks are paid out of the Escrow Cash or Bank Account.

The total amount paid by the reservations that were on the finalized owner statements is removed from the Advanced Reservation Deposits liability account.

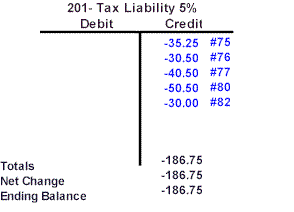

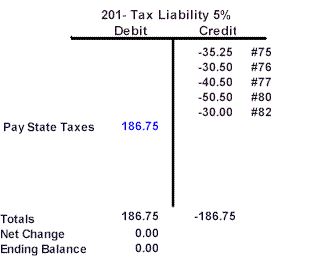

This Tax Liability account reflects the 5% taxes paid by the reservations that are now due to be paid.

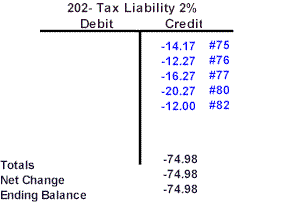

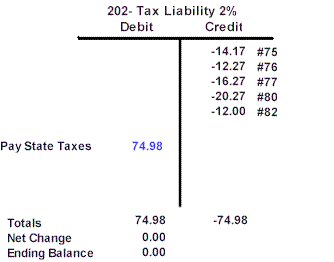

This Tax Liability account reflects the 2% taxes paid by the reservations that are now due to be paid.

This account shows the income to the owners from the finalized reservations and then the checks paid to the owners.

We have not paid the vendor yet, so there is no activity in this account.

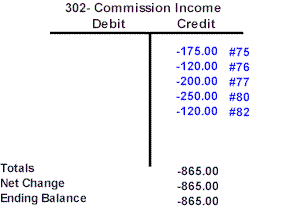

This account shows the commissions earned for the reservations reported on the owner statements.

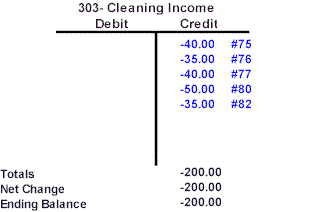

This Cleaning account shows the cleaning income charged for the reservations on the owner statements.

This account shows the books sold charges for the reservations on the owner statements.

This account shows the embedded reservation fee charges for the reservations on the owner statements.

Pay Vendor, Taxes & Rental Company

The following T account diagrams will show what the accounts involved when paying Handyman Randy will look after we pay him.

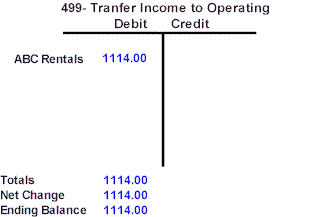

ABC Rentals also wants to get paid. Rhonda the bookkeeper adds up the income for the month and writes a check for the total amount=1114.00

|

Commission |

865.00 |

|

Cleaning |

200.00 |

|

Books |

14.00 |

|

Fees |

35.00 |

|

Total |

1114.00 |

The check is posted to the transfer Income to Operating Account (#499). This is done because ABC Rentals does not track its operating accounts using RMS. If ABC Rentals did track its operating accounts using RMS, the check would have been posted to an Operating Cash account.

An entry is created in Accounts Payable for the taxes owed. ABC Rentals has already set up the state and county tax vendors. Settings in the vendor file tell the Accounts Payable entry screen which account to pay off (debit) when the check is processed for the vendor.

A Check was set up in Accounts Payable and processed to pay the state tax.

A check was set up in Accounts Payable and processed to pay the county tax.

The check that was set up when the work order was posted is processed using Accounts Payable.

This is the first time this account has had any activity in our example.

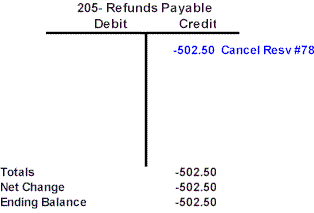

Cancelled Reservation

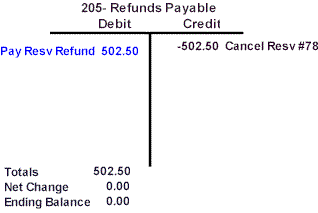

The guest who booked reservation #78 called ABC Rentals and cancelled their reservation. When a reservation that has money paid is cancelled an automatic General Ledger entry is created. This entry reduces (debits) the Advanced Reservation Deposits account (200) and increases the Refunds Payable account (205). The liability for the reservation’s money is swapped from one liability account to another. An Accounts Payable entry is automatically created and is used to refund. The money can also be partially refunded and distributed to various places. Some companies may earn a cancellation fee or post a portion to the owners unit account.

This account shows that the money paid by the reservation is now due to be refunded.

After the ABC Rentals writes the check, the Escrow Cash in Bank is credited for the amount of the cancellation refund. The Refunds Payable is debited.

|

Account # |

Account Name |

Ending Balance |

|

98 |

MasterCard/Visa Clearing |

0.00 |

|

99 |

Cash to Deposit |

0.00 |

|

101 |

Owner Held Deposits |

0.00 |

|

110 |

Escrow Cash In Bank |

0.00 |

|

200 |

Advanced Reservation Deposits |

0.00 |

|

201 |

Tax Liability 5% |

0.00 |

|

202 |

Tax Liability 2 % |

0.00 |

|

205 |

Refunds Payable |

0.00 |

|

210 |

Owner Liability |

0.00 |

|

231 |

Accounts Payable-owner Behalf |

0.00 |

|

302 |

Commission Income |

-865.00 |

|

303 |

Cleaning Income |

-200.00 |

|

314 |

Books Sold Income |

-14.00 |

|

317 |

Reservation Fee Income |

-35.00 |

|

499 |

Transfer Income to Operating |

1114.00 |

|

|

Totals for Ledger |

0.00 |

|

|

|

|

The account balances are also shown below on the

Income Statement and Balance Sheet. RMS can print an Income Statement and

Balance Sheet from the General Ledger Menu.

|

Income Statement | ||

|

Income |

|

|

|

302 – Commission Income |

865.00 |

|

|

303 – Cleaning Income |

200.00 |

|

|

314 – Books Sold Income |

14.00 |

|

|

317 – Reservation Fee Income |

35.00 |

|

|

Total Income |

1,114.00 | |

|

Expenses |

|

|

|

499-Transfer Income to Operating |

1,114.00 |

|

|

Total Expenses |

1,114.00 | |

|

Total Profit/Loss |

0.00 | |

|

Balance Sheet | ||

|

Assets |

|

|

|

98 – MC/Visa Clearing |

0.00 |

|

|

99 – Cash to Deposit |

0.00 |

|

|

101 – Owner Held Deposits |

0.00 |

|

|

110 – Escrow Cash in Bank |

0.00 |

|

|

Total Assets |

0.00 | |

|

| ||

|

Liabilities & Equity |

|

|

|

200 – Adv Reservation Deposits |

0.00 |

|

|

201 – Tax Liability – 5% |

0.00 |

|

|

202 – Tax Liability – 2% |

0.00 |

|

|

205 – Refunds Payable |

0.00 |

|

|

210 – Owner Liability |

0.00 |

|

|

231 – A/P – Owner Behalf |

0.00 |

|

|

Total Liabilities |

0.00 | |

Equity |

|

|

|

Current Income |

0.00 |

|

|

Total Equity |

0.00 | |

|

| ||

|

Total Liabilities & Equity |

0.00 | |