All transactions in double-sided accounting have a minimum of two entries, a debit and a credit. The total of the debits must equal the total of the credits. This rule is used to keep the accounting system in balance. The Resort Management System enforces this rule. The following general examples are shown to illustrate how typical entries affect accounts.

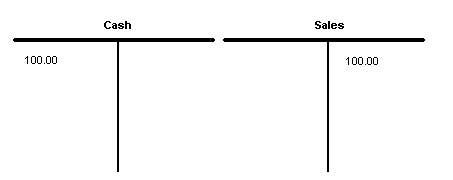

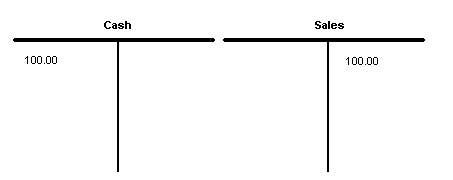

1) A cash sale is made to Joe’s Plumbing in the amount of $100.00.

Remember, the left side of a T account shows debits and the right side shows credits. In the above example, cash was debited $100.00, increasing the asset, and sales was credited $100.00, increasing the income account.

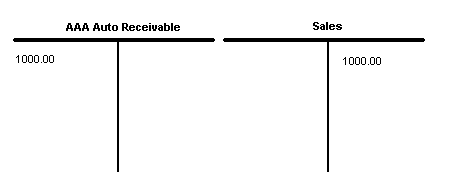

2) A sale is made to AAA Auto for $1000.00. AAA Auto will be billed at the first of the month thus creating a receivable.

AAA Auto Receivable is an asset account, so the account was debited in order to increase its value.

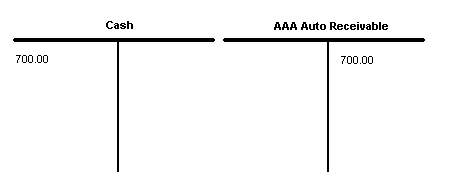

3) AAA Auto pays $700.00 towards their account

Cash is debited, increased, and AAA Auto Receivable is credited thus reducing the amount they owe.

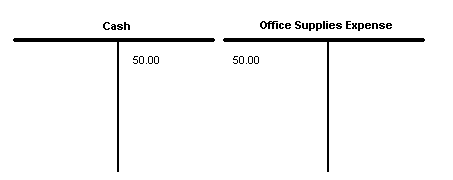

4) The company purchases office supplies for $50.00.

Cash is credited, decreased, and Office Supplies Expense is debited, increasing the expense account.

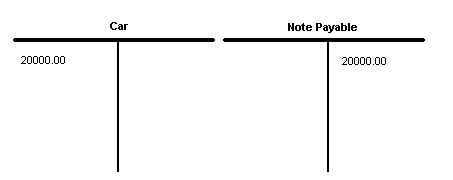

5) The company secures a bank note and purchases a car.

The new asset account Car is debited for the car’s value and the liability Note Payable is credited.

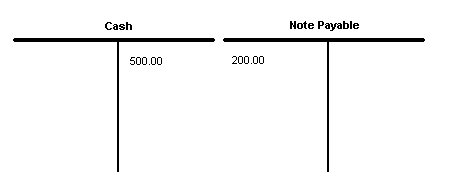

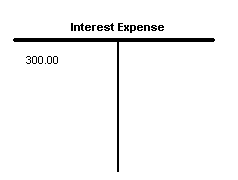

6) The company pays a car payment.

In this example three accounts are used. Note the two debits equal the single credit. The company knows how much of their payment is for interest, an expense, and how much goes towards the note, reducing the liability. Some companies expense the entire payment to one account and make a year-end adjustment to reflect the actual interest expense and note reduction.